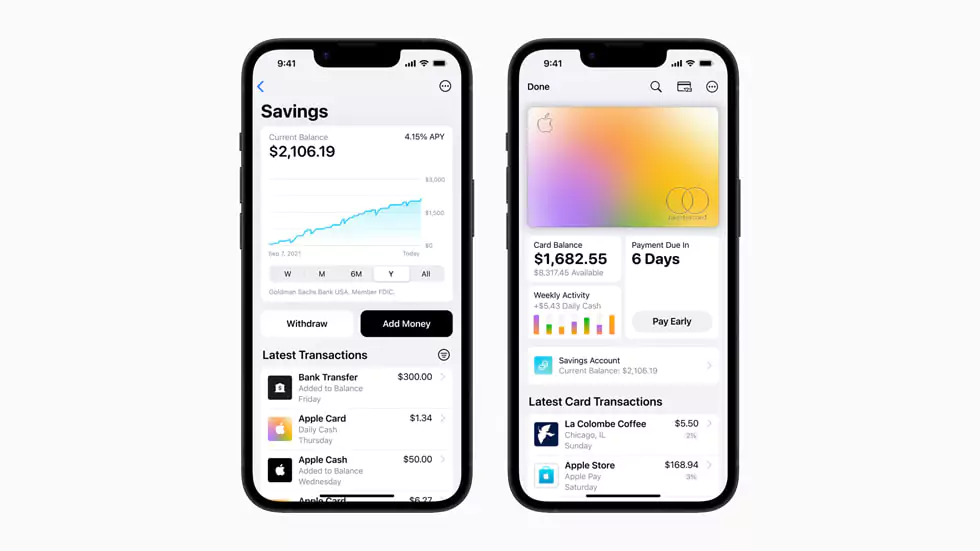

The new Savings account from Apple Card is currently available and offers a 4.15% APYS. As of right now, Apple Card holders have the option of increasing their Daily Cash benefits by opening a Goldman Sachs savings account, which offers a high-yield APY of 4.15%, which is more than 10 times the national average. Users may quickly set up and manage their savings account straight from Apple Card in Wallet without paying any fees, making any minimum contributions, or maintaining any minimum balance restrictions.

According to Jennifer Bailey, Apple’s vice president of Apple Pay and Apple Wallet, “Savings enables our consumers to get even more value out of their favourite Apple Card, benefit Daily Cash while giving them a simple opportunity to save money every day.” Savings were included in the Apple Card in Wallet to allow users to spend, send, and save Daily Dollars directly and conveniently from one location. “Our objective is to provide tools that help consumers lead better financial lives,” the company states.

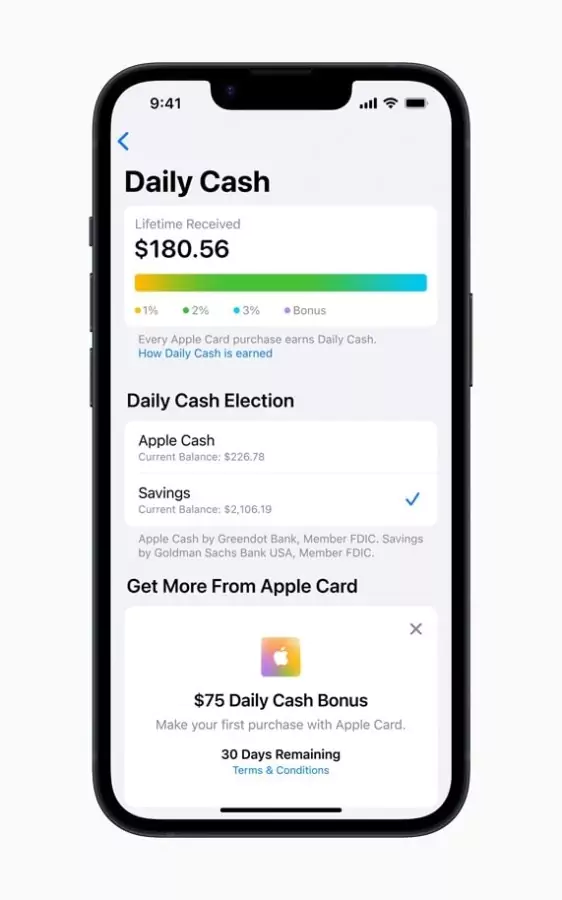

Every future Daily Dollar that the user earns will be automatically put into the Savings account once it is set up. There is no cap on how much money Daily Cash users can make, and the Daily Cash destination can be changed anytime. Users may add more money to their savings using a connected bank account or from their Apple Cash balance in order to increase their savings even further.

Customers may quickly check their account balance and interest amount over time by using an easy-to-use Savings dashboard in Wallet, which is available to them. A connected bank account or an Apple Cash card can be used to withdraw money at any time, with no fees, using the Savings dashboard.

completely no fees, Daily Cash for every purchase, and tools that encourage users to pay less interest on their Apple Card balances, the new Goldman Sachs Savings account expands on the advantages for users’ financial health that the Apple Card already provides, all while providing the privacy and security that customers have come to expect from Apple.